The war in Ukraine choked off supplies of the wire harness, an inexpensive component that bundles cables together.

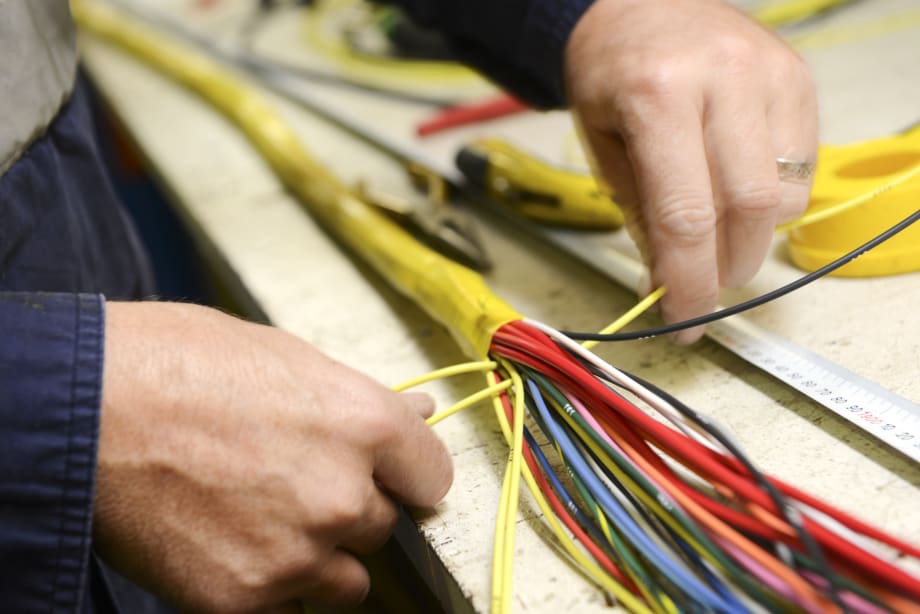

These parts comprised of wire, plastic and rubber and manufactured with manual labor may not command the attention of microchips and motors, but cars can't be built without them.

The shortage of wire harnesses could accelerate automaker plans to move to lighter, machine-made harnesses used in EVs.

“This is just one more rationale for the industry to make the transition to electric quicker,” said Sam Fiorani, head of production forecasting firm AutoForecast Solutions.

Currently, gasoline cars account for the bulk of new car sales globally. In contrast, EVs still only comprised 6% of vehicle sales, according to data from JATO Dynamics.

Nissan CEO Makoto Uchida told Reuters upply-chain disruptions had prompted his company to engage suppliers in talks about shifting away from cheap wireharnesses produced by manual labor.

In the meantime, automakers and suppliers have moved wire harness production to other lower-cost countries. Mercedes-Benz flew in harnesses from Mexico to plug a brief supply gap, according to a person familiar with its operations. Some Japanese suppliers added capacity in Morocco, while others sought new production lines in Tunisia, Poland, Serbia and Romania.

Harnesses for fossil-fuel cars bundle together cables stretching up to 3.1 miles in the average vehicle, connecting everything from seat heaters to windows. They are made by hand and almost every uses a unique wire harness.

The supply disruptions in Ukraine appeared dire when the war first broke out. Adrian Hallmark, CEO of Bentley, said the company initially feared losing 30%-40% of its car production in 2022 due to a harness shortage.

Hallmark noted that finding alternative production sources became complicated because the conventional harnesses used 10 different parts from 10 different suppliers in Ukraine.

Bentley has shifted its focus and investment to developing a simple harness run by a central computer for EVs. The carmaker, a division of Volkswagen, plans a full electric lineup by 2030.

The new generation of wire harnesses, already favored by Tesla, can be made in sections on automated production lines and are lighter weight, which helps EVs extend their range.

Walter Glück, head of Leoni's harness business, said the supplier now works with automakers on new, automated solutions for wire harnesses in EVs.

Leoni focuses its efforts on zonal or modular harnesses, which can split into six to eight parts, short enough for automation in assembly.

"It's a change of paradigm," Glück said. "If you want to reduce production time in your car factory, a modular wire harness helps."

BMW also seeks to use modular wire harnesses, requiring fewer semiconductors and less cable, according to an anonymous source. The new harnesses also will make it easier to upgrade vehicles wirelessly as Tesla already does.

CelLink, a Californian-based startup, has already developed an entirely automated, flat and easy-to-install "flex harness", and raised $250 million earlier this year from companies including BMW and auto suppliers Lear Corp and Robert Bosch.

CEO Kevin Coakley reports CelLink's new $125 million factory in Texas will have 25 automated production lines that can switch to different harness designs within 10 minutes because the factory produces components from digital files.

The company seeks to build another plant in Europe, he said.

The lead time for a conventional wire harness can exceed 26 weeks, but Coakley said his company can ship redesigned products in two weeks.